Consolidation: how it benefited customers. In 2010, at SEMI’s ITPC, Bob Bruck posed the hypothesis to me that consolidation was good for customers. Being an economist, firmly grounded in anti-trust teachings, my gut pushed back. But Bob came up with a good point: fewer competitors means less duplicative R&D, which makes the equipment industry more efficient, which should translate into lower cost. He had inverted my Maxim that the number of competitors in any tech market is a function of the base R&D spending needed to develop new generations. But if he was right, there would be a second benefit of less duplicative SG&A. Moreover, it was a two-way street. Consolidation in the semiconductor industry would mean less duplicative SG&A for the equipment industry as well. Hence, tools would be less expensive and semiconductor capital efficiency would be greater. Then he threw down the gauntlet: could it be proven? The short answer is that it can.

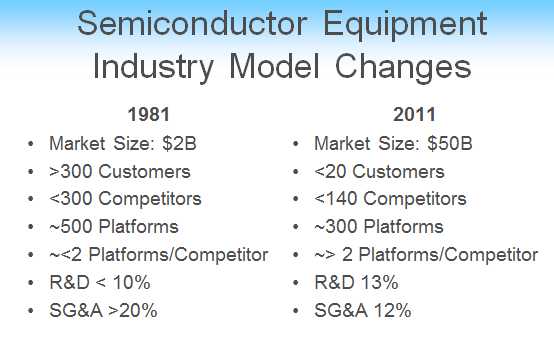

If we compare the industry today versus its structure three decades ago, one can take the number of customers and competitors with the R&D and SG&A to then model what these expenses would look like today without any structural change.

There is an order-of-magnitude fewer customers and roughly half the number of equipment suppliers competing in the market. R&D is slightly more as a percent of sales, while the share SG&A holds is roughly half of what it was.

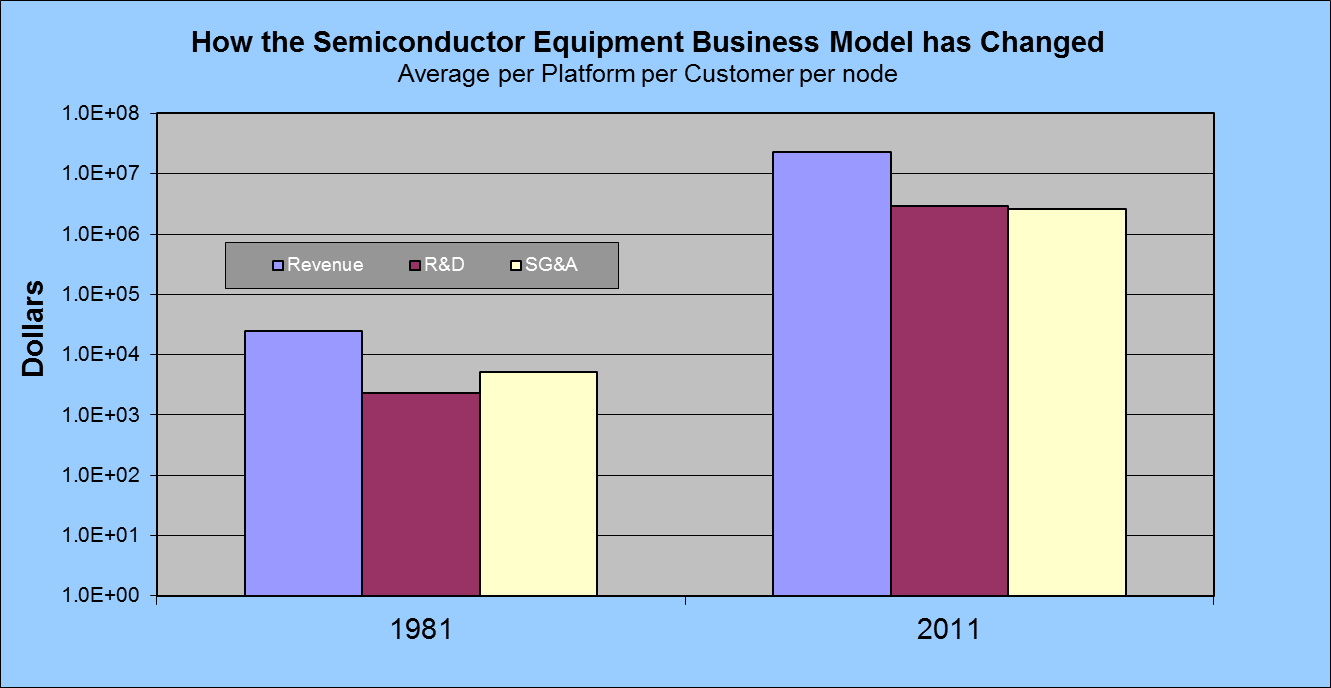

VLSI’s data shows that revenue, R&D, and SG&A per platform have risen 3 orders of magnitude over the last 3 decades. What cost tens of thousands to do in 1981 now costs tens of millions. Lithography has risen four orders of magnitude over the last 3 decades!

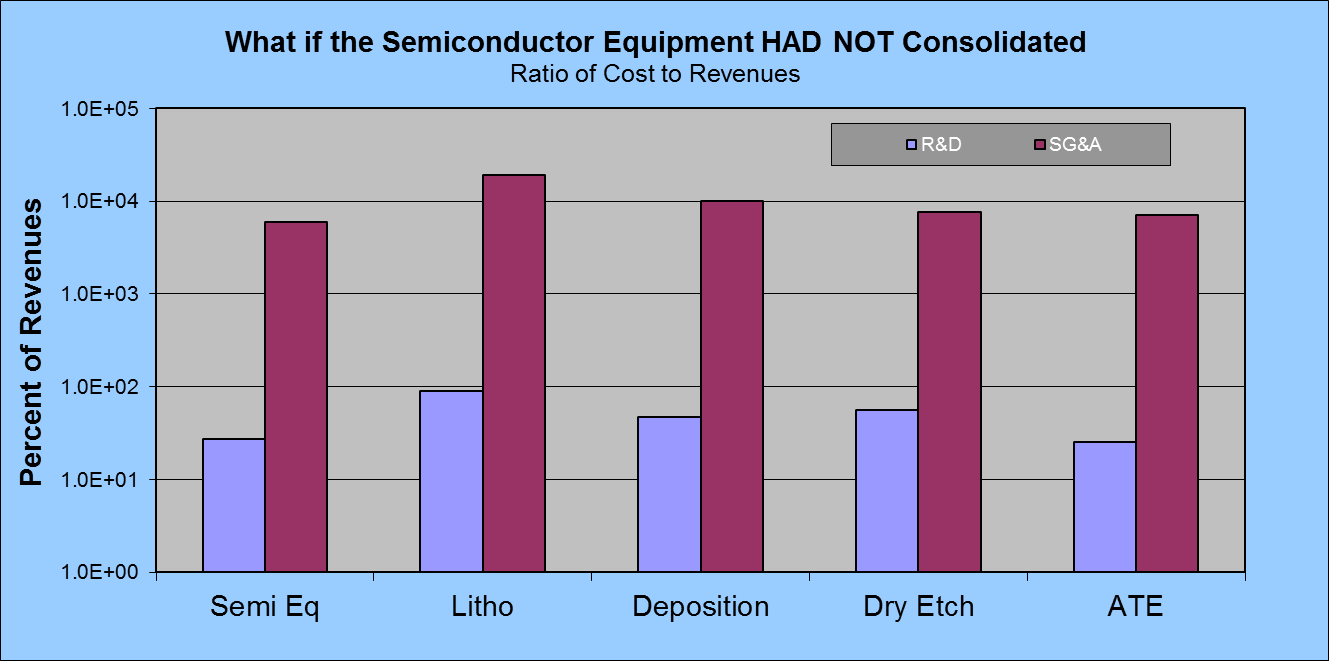

Taking today’s costs per platform per customer and, assuming that the same number of customers and competitors still exists, yields the following chart:

If the semiconductor equipment industry had not consolidated, R&D would between 50 and 100% of industry revenues. In order to sustain such an R&D load would mean the equipment industry would have to be sized similar to today’s total IC sales. But that’s not the half of it. Without consolidation, SG&A would approach 10,000%, taking the sustainable revenue level to more than $30T, which is more than an order of magnitude larger than the entire electronics industry! In other words, Moore’s Law would have been broken long ago.

So the lesson to learn is that real market forces in the form of escalating costs for developing and selling technology have driven consolidation. That the benefit has been a far more efficient industry. Finally, in honor of the individual who challenged me to dig deeper and who posed the hypothesis, I name this principle, Bruck’s C3 Rule for Consolidation Contains Cost escalation.

Are equipment manufacturers more efficient at spanning multiple markets? Another interesting observation came out of the effort to show the effect of consolidation on the semiconductor supply chain. You will note from the chart above that the number of platforms per competitor has not changed much even with consolidation. This proves something my dad and I analyzed back in the late seventies: that tech companies tend to segment on the basis of technical core strengths. My dad had observed it in buying chip equipment when he ran manufacturing, then when we started collecting the data, I found that, sure enough, there was a strong correlation to technical strengths and market segment shares of competitors.

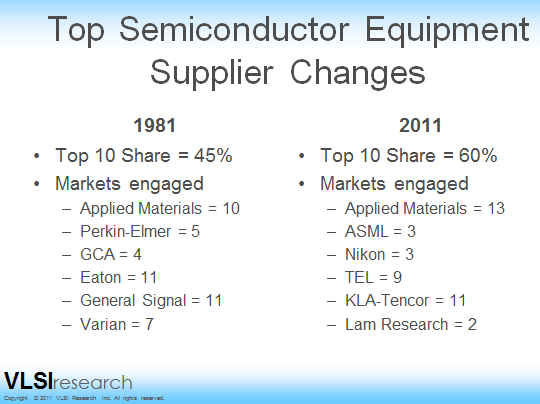

Now you might think that surely the top equipment suppliers span more market areas than competitors from the early eighties. But check the chart below.

While the market share of the Top 10 suppliers went from 45% to 60%, the number of markets they engage in has gone down. Back in the Eighties, companies like Eaton and General Signal tried to consolidate multiple suppliers into single one-stop equipment shopping centers. It didn’t work. If you look at today’s leaders, their best market positions come from products they organically developed rather than used M&A to enter. So while consolidation may be good for the industry as a whole, it is not necessarily good for acquirers of tech companies.

Originally published in The Chip Insider™ on January 7, 2011 by G Dan Hutcheson

Copyright © VLSI Research Inc. All rights reserved.