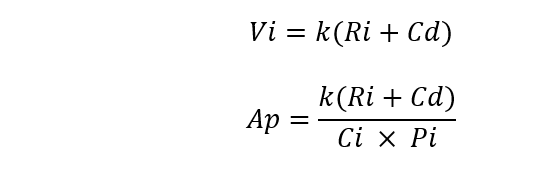

It is a fundamental principle that a new technology will only be adopted when value to the customer is significantly greater than the potential monetary cost times a non-monetary multiple for making the changes needed to implement it. The monetary implementation costs to the customer are typically easy to define with simple metrics like initial cost, price, and Cost of Ownership. More typically, product development teams are tripped up when assessing the value of a solution (i.e. a product per the maxim) to the customer or the non-monetary cost multiple of implementation, which is dictated by the number of hoops a customer must jump through to implement a technology.

The value to the customer is determined by the sum of the increased revenue and the decreased cost after implementation times the customer’s hidden depreciative constant (typically a 0-1 value, but occasionally greater than one). For example, the depreciative multiple of a yield gain is often 0.00-something, as most customers will see yield gains along the lines of the saying, “If I had a dollar for every percent yield gain, I’ve been promised, I’d be rich.” It takes great marketing, like the kind KLA does regularly, to raise this multiple.

Where:

Ap = Technology Adoption Probability

Vi = Value of implementation

Ri = Revenue increase after implementation

Cd = Cost decrease after implementation

k = Customer’s hidden depreciative constant

Ci = Cost of implementation

Pi = Perceived Pain of implementation

KLA has raised the depreciative constant to greater than one by showing that there is additional value to a yield gain in eliminating the downstream costs of additional process steps on bad wafers. Another bump for them was the discovery that higher yield also equates to higher reliability in the field where rule-of-ten cost factors weigh in. Importantly, KLA first sells the customer by building consensus among them through user forums. User forums network customers, making individual buy-ins to a new value proposition more visible. This builds FOMO among those who have yet to buy-in, driving them to buy-in for Fear Of Missing Out. Note that Metcalfe’s Law on networks also applies here, as the value of such forums are an exponential of the number of customers.

Accounting and decision metrics are other depreciative factors a product development team must be wary of. This is particularly true when the cost reduction is in facilities. One new tool I worked with would payback its initial cost in power savings alone — each year! It turned out to be a hard sell, because some customers were primarily accountable for only capital costs — as one rejector put it so well, “power is not in my budget.” In another case, yield was not factored into a tool shoot-out at a customer site. The tool that won was producing more die-per-unit-of-time. But it was damaging product in the process. The net good product out of the winning tool was materially less than the slower tool, which cost more yet had integrated sensors to eliminate most of the product damage. It took a CEO call to sort out this one. Marketing issues like these require moving up the decision chain of an organization to reset the customer’s choice. Extremely deft sales skills are required, because challenging them is equivalent to telling the customer they’re stupid. Great sales professionals are able to bring customer realization of these points without telling them (The ‘sell them, don’t tell them’ technique).

The perceived pain of implementation is a non-monetary cost multiple the customer places on adopting a new technology. It is the most difficult question to answer because the factors driving them are typically hidden or unknown. Multiples are often raised for reasons related to risk or personal obstacles. For example, how many late nights and weekends are a customer going to lose in making the change or the threat of an unknown unknown putting their career in jeopardy. Lowering this obstacle can start with product design. Steve Jobs of Apple was an absolute genius at lowering this value to near zero. A counter-intuitive factor that can lower this multiple to less than one is higher prices, which are often favored by decision-makers because the size of a decision-maker’s budget is proportional to their status, pay, and bonuses in an organization. Hence, any decision-maker that can sell higher priced tools internally will tend to rise in importance. It’s an organizational form of Darwin’s “survival of the fittest.” Great sales professionals track these people down like blood hounds after a lost child in the forest.

Now this doesn’t mean that buy decisions are made on this basis alone. Higher prices must be accompanied by measurable value of the deal to the customer’s company. If not, everyone loses in the long term. But it remains an influencer, as higher priced products have tended to win greater market share over lower prices for decades. Market leaders like TSMC, Intel, Qualcomm, and Samsung are key examples of companies with higher price points1 that have gained a leadership market share.

A progression of this can be visibly seen in the cadence of lithography tool market share shifts, which have always favored higher priced tool offerings. The corporate leadership history of lithography starts with Kulicke and Soffa, moves to Cobilt and Kasper, then to Perkin-Elmer, on to GCA, Nikon, and finally ASML. Each step along the way, the emerging leader focused on adding real value, while insisting on commanding a higher price.

On another level, look at how nano-imprint lithography (NIL) never went mainstream. These tools have always been extremely low priced, yet few companies have ever devoted the level of resources to developing this technology as they have with conventional optical tools.2 This can be seen at play in how rapidly problems with NIL technology circulate the industry, keeping serious inquiry off the radar screen. The problems with NIL are always real: defectivity, 1X masks, low throughput, lagging resolution. But lack of resources has limited progress in these areas, which takes you back to a low non-monetary cost multiple based on personal issues as well as the risk of failure.

The value to your company can be determined by the size of the problem. Since problems are markets (see maxim), the TAM of your value is the average cost to each customer of the problem times the number of customers.

Key Questions to answer before launching any product/technology development effort

What problem does it solve?

-

- Can the problem you’re solving define a new category that builds a market base for the technology (i.e. maxim of Problems are Markets. Solutions are Products)?

- What’s the value to the customer in solving that problem?

- How will the customer calculate that value?

- What factors form the customer’s depreciative constant?

- What are the costs of implementation?

- What are the key factors forming the non-monetary cost multiple?

- Organizational versus personal risks?

- How invasive is it to their flows?

- What are the FOMO, FOWO and FOBO factors driving or stalling the customer?

- Fear Of Missing Out: Will they lose competitiveness if they don’t adopt?

- Fear Of a Worse Option: i.e. the ‘nobody ever got fired by buying from XYZ’ factor and other risks inside the unknown unknown questions.

- Fear Of a Better Option: Can a better resourced competitor stall a decision with the promise of a better future, starving the innovator out.

- Why you?

- Why now?

- The market must be ready for the solution.

- Being early to market is a product adoption disaster, as low urgency for a solution lowers its value.

- Being late to market is also a product adoption disaster, as lack of differentiation takes you down the rat hole of having no alternative beyond lower prices. This starves a company of the funds needed to develop its next great solution.

- What are the key factors forming the non-monetary cost multiple?

1: I should also mention there is a virtuous cycle in systematically having higher prices, as in addition to greater profits, you will either have the capital or have access to it to invest more in R&D. Hence, innovation accelerates in companies that can lead a market with higher prices. But be careful, as it is a double-edged sword, as customers will quickly turn against you if your company fails to innovate.

2: Of course, the name didn’t help, as first they were IL and then they were NIL.